The Online Recruitment Software Market Competitive Landscape features diverse participants ranging from enterprise HCM suite providers to specialized recruitment platforms and innovative startups. Competition intensity continues increasing as recruitment technology becomes critical business infrastructure. The Online Recruitment Software Market size is projected to grow USD 34.99 Billion by 2035, exhibiting a CAGR of 8.31% during the forecast period 2025-2035. Enterprise platform vendors leverage comprehensive suites for integrated talent management delivery. Specialized vendors differentiate through focused innovation and superior recruitment functionality. AI-native startups challenge established players through advanced automation capabilities.

Major enterprise HCM vendors including Workday, Oracle, and SAP maintain substantial competitive positions. Workday provides recruiting integrated with comprehensive human capital management capabilities. Oracle HCM Cloud delivers enterprise recruitment within broader cloud HR platform. SAP SuccessFactors offers recruiting as part of integrated talent management suite. Ceridian Dayforce provides recruiting within unified HCM platform. UKG delivers recruitment capabilities within comprehensive workforce solutions.

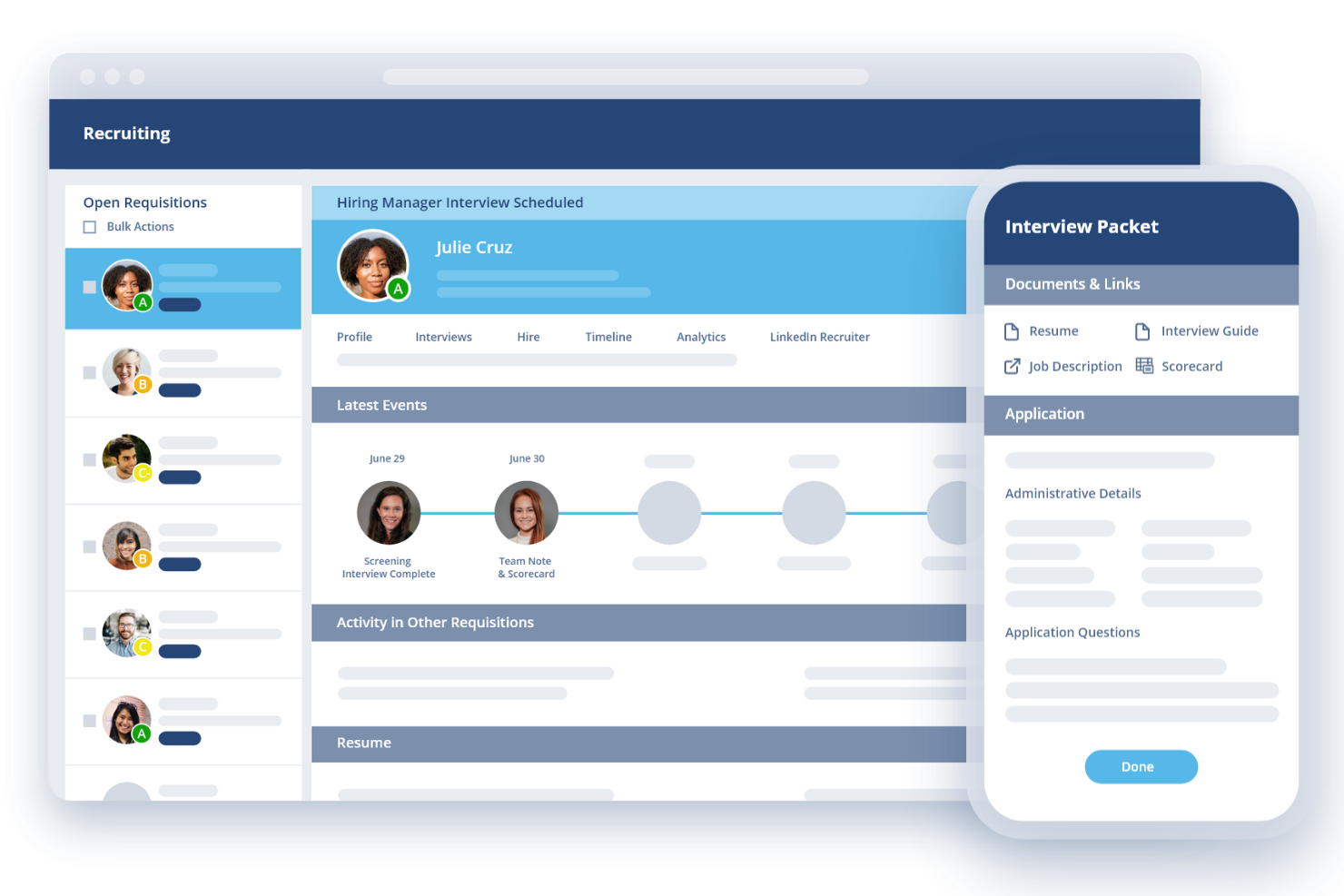

Specialized recruitment software vendors compete through focused innovation and best-of-breed functionality. Greenhouse provides structured hiring platform emphasizing candidate experience and interview quality. Lever delivers collaborative recruiting platform enabling team-based hiring processes. iCIMS offers enterprise talent acquisition suite serving high-volume requirements. SmartRecruiters provides modern recruiting platform with marketplace ecosystem. Bullhorn delivers staffing industry-focused recruitment and CRM platform. Jobvite offers comprehensive talent acquisition including recruitment marketing.

Competitive strategies include AI differentiation emphasizing intelligent automation and matching. User experience strategies prioritize intuitive interfaces reducing training requirements. Integration strategies emphasize connectivity with broader HR technology ecosystems. Vertical specialization strategies address industry-specific recruitment requirements. Customer success strategies emphasize implementation support and ongoing optimization. Pricing strategies range from per-seat subscription to usage-based models.

Top Trending Reports -

Software Analytics Market Competitive Landscape