The Motion Control Software In Robotics Market Competitive Landscape features diverse participants ranging from integrated robot manufacturers to specialized software providers and automation platform vendors. Competition intensity continues increasing as motion control becomes critical differentiator in robotic performance. The Motion Control Software In Robotics Market size is projected to grow USD 8.588 Billion by 2035, exhibiting a CAGR of 11.25% during the forecast period 2025-2035. Robot manufacturers leverage integrated control for seamless hardware-software optimization. Automation platform vendors emphasize cross-platform compatibility and ecosystem integration. Open-source initiatives challenge proprietary solutions through community development.

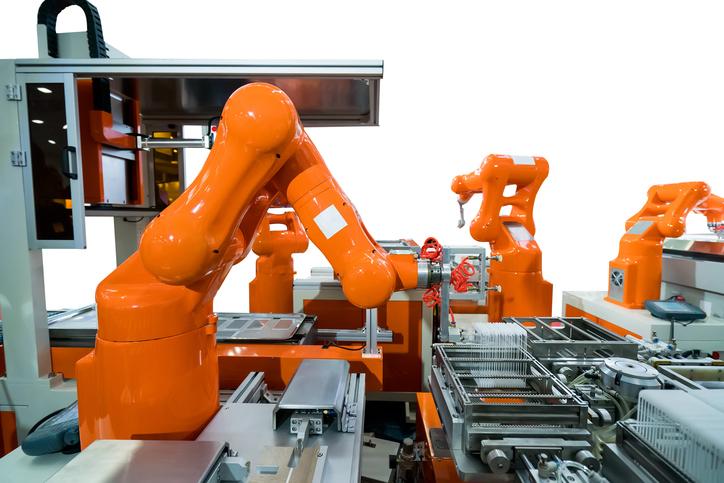

Major robot manufacturers including FANUC, ABB, KUKA, and Yaskawa maintain substantial competitive positions. FANUC provides deeply integrated motion control optimized for proprietary robot hardware. ABB delivers comprehensive motion capabilities through RobotStudio development environment. KUKA offers advanced motion control supporting diverse industrial applications. Yaskawa Motoman provides motion control emphasizing welding and handling excellence. Universal Robots delivers intuitive motion programming for collaborative robot applications.

Automation platform vendors compete through comprehensive industrial control offerings. Siemens provides motion control integrated within broader automation and digitalization portfolio. Rockwell Automation delivers motion capabilities through Logix platform ecosystem. Beckhoff offers software-based motion control with PC-based automation advantages. OMRON provides integrated motion, sensing, and safety solutions. Mitsubishi Electric delivers motion control within comprehensive factory automation platform.

Competitive strategies include algorithm sophistication emphasizing motion performance and intelligence. Integration depth strategies optimize hardware-software interaction for enhanced performance. Open architecture strategies enable flexibility and third-party ecosystem participation. Industry specialization strategies focus on specific vertical application requirements. Service excellence strategies provide implementation support and ongoing optimization. Acquisition strategies accelerate capability development through purchasing specialized companies.

Top Trending Reports -

Smart Highways Market Competitive Landscape

IoT For Public Safety Market Competitive Landscape

Application Performance Management Market Competitive Landscape